take home pay calculator maryland

It can also be used to help fill steps 3. New employers will pay a 23 tax rate and established employers pay rates between 22.

How To Find The Best Heloc Rates In Maryland Atlantic Financial Fcu

The Maryland Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023 and Maryland State.

. If you are a new. The latest budget information from April 2022 is used to. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

How to calculate annual income. Home Maryland Taxes Marylands Money Comptroller of Maryland Media Services Online Services Search. For example if an employee earns 1500.

The overall odds of winning a prize are 1 in 249 and the odds of winning the. How do I calculate hourly rate. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Calculate your Maryland net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Maryland. Net Pay Calculator with Updated W-4 This version of Net Pay Calculator should be used by those who submitted Federal W-4 in 2020 or later. Just enter the wages tax withholdings and.

Lump sum payout after taxes. Use this Maryland gross pay calculator to gross up wages based on net pay. If you have any questions please contact our Collection Section at 410-260-7966.

This net pay calculator can be used for estimating. Your take-home pay is the difference between your gross pay and what you get paid after taxes are taken out. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your.

Need help calculating paychecks. It can also be used to help fill steps 3 and 4 of a W-4 form. Annuity payout after taxes.

Maryland Paycheck Calculator Use ADPs Maryland Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. How much youre actually taxed depends on various factors such as your marital. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

Payroll Schedules Salary Scales Forms Contact Information. These rates of course vary by year. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

For example if an employee receives 500 in take-home pay this calculator can be. Maryland Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Next divide this number from the.

For 2022 Marylands Unemployment Insurance Rates range from 1 to 105 and the wage base is 8500 per year. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Maryland Hourly Paycheck and Payroll Calculator.

Marylands unemployment tax is charged on the first 8500 of each employees salary each year. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Quarterly Estimated Tax Calculator - Tax Year 2022.

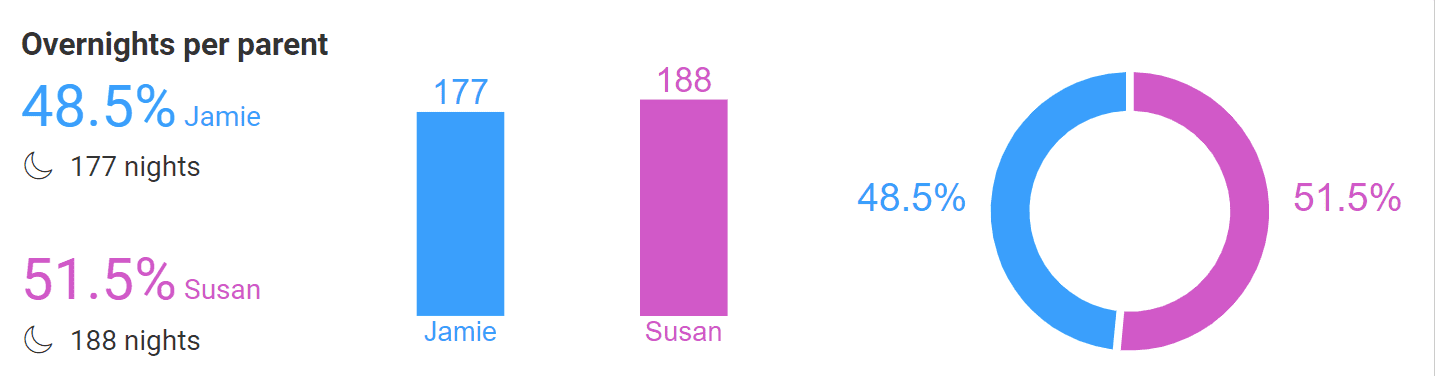

The Easiest Maryland Child Support Calculator Instant Live

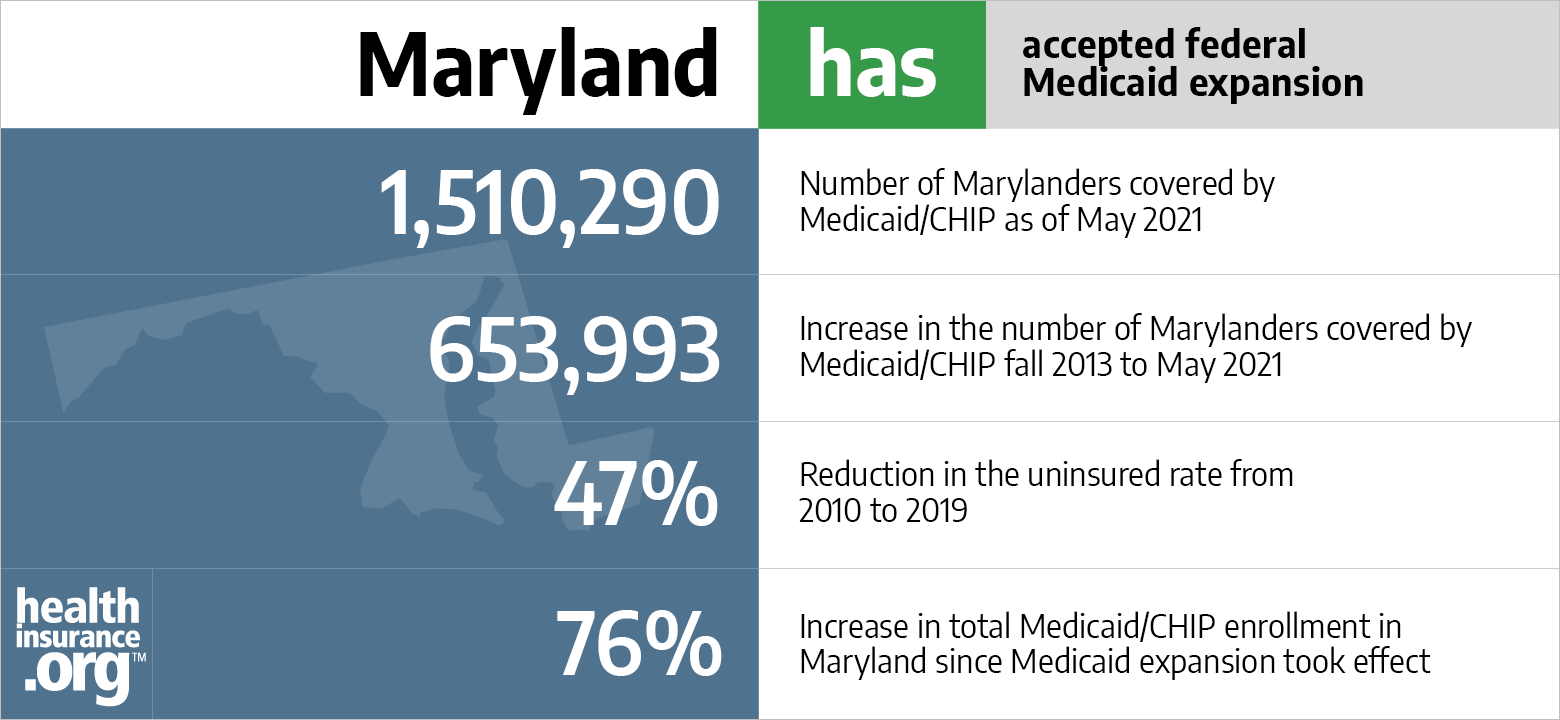

Aca Medicaid Expansion In Maryland Updated 2022 Guide Healthinsurance Org

Housing Choice Voucher Program Hcvp

New York Hourly Paycheck Calculator Gusto

Maryland Self Employment Tax Calculator 2020 2021

Maryland Salary Paycheck Calculator Gusto

Maryland Paycheck Calculator Adp

Maryland Income Tax Calculator Smartasset

Mymdthink Programs Services Portal

How Much Does It Cost To Raise A Child Washington Post

Advanced Paycheck Tax Calculator By Ryan Soothsawyer

Maryland Refundwhere S My Refund Maryland H R Block

Maryland Smartbuy 3 0 Buy A Home Get Rid Of Student Loan Debt Student Loan Hero

Salary Paycheck Calculator Calculate Net Income Adp